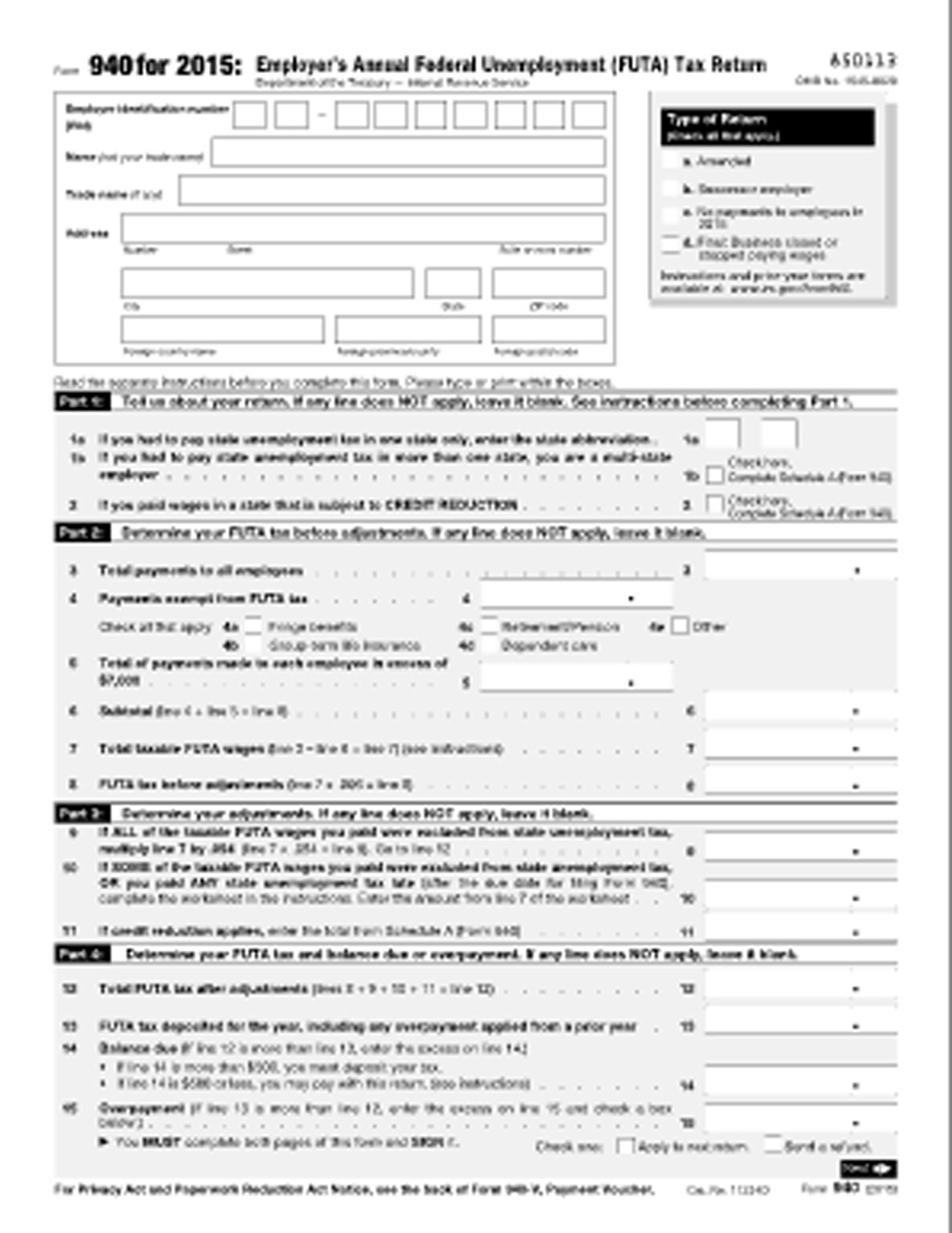

Generally, employers are required to file Forms 941 quarterly. However, some small employers (those whose annual liability for Social Security, Medicare, and withheld. What is the difference between 940 and 941? Form 940 is used to report FUTA taxes, while Form 941 is used to report federal income tax withheld, Social Security, and Medicare tax. Get an overview of the differences between IRS Form 940, Form 941, and Form 944 to ensure tax compliance by filing them accurately and on time.

Get an overview of the differences between IRS Form 940, Form 941, and Form 944 to ensure tax compliance by filing them accurately and on time. Form 940 is required for businesses who are subject to Federal Unemployment (FUTA). The 940 is an annual federal tax form used to report wages subject to and taxes paid for FUTA. This. The difference between form 940 and form 941 is that form 940 is filed annually and reports an employer’s Federal Unemployment Tax liability. While form 941 reports the Federal. The main distinction between Form 940 and 941 is that Form 940 documents FUTA tax, which is paid exclusively by the employer. In contrast to this, Form 941 represents. While Form 940 focuses on annual Federal Unemployment Tax Act (FUTA) liabilities, Form 941 deals with quarterly income tax withholding, Social Security tax, and.

The difference between form 940 and form 941 is that form 940 is filed annually and reports an employer’s Federal Unemployment Tax liability. While form 941 reports the Federal. The main distinction between Form 940 and 941 is that Form 940 documents FUTA tax, which is paid exclusively by the employer. In contrast to this, Form 941 represents. While Form 940 focuses on annual Federal Unemployment Tax Act (FUTA) liabilities, Form 941 deals with quarterly income tax withholding, Social Security tax, and. The primary difference between Form 940 and Form 941 is the tax liability reported. Form 940 reports FUTA taxes, while Form 941 reports income tax, Social Security tax, and.

Who's Travis Scott Dating 2024