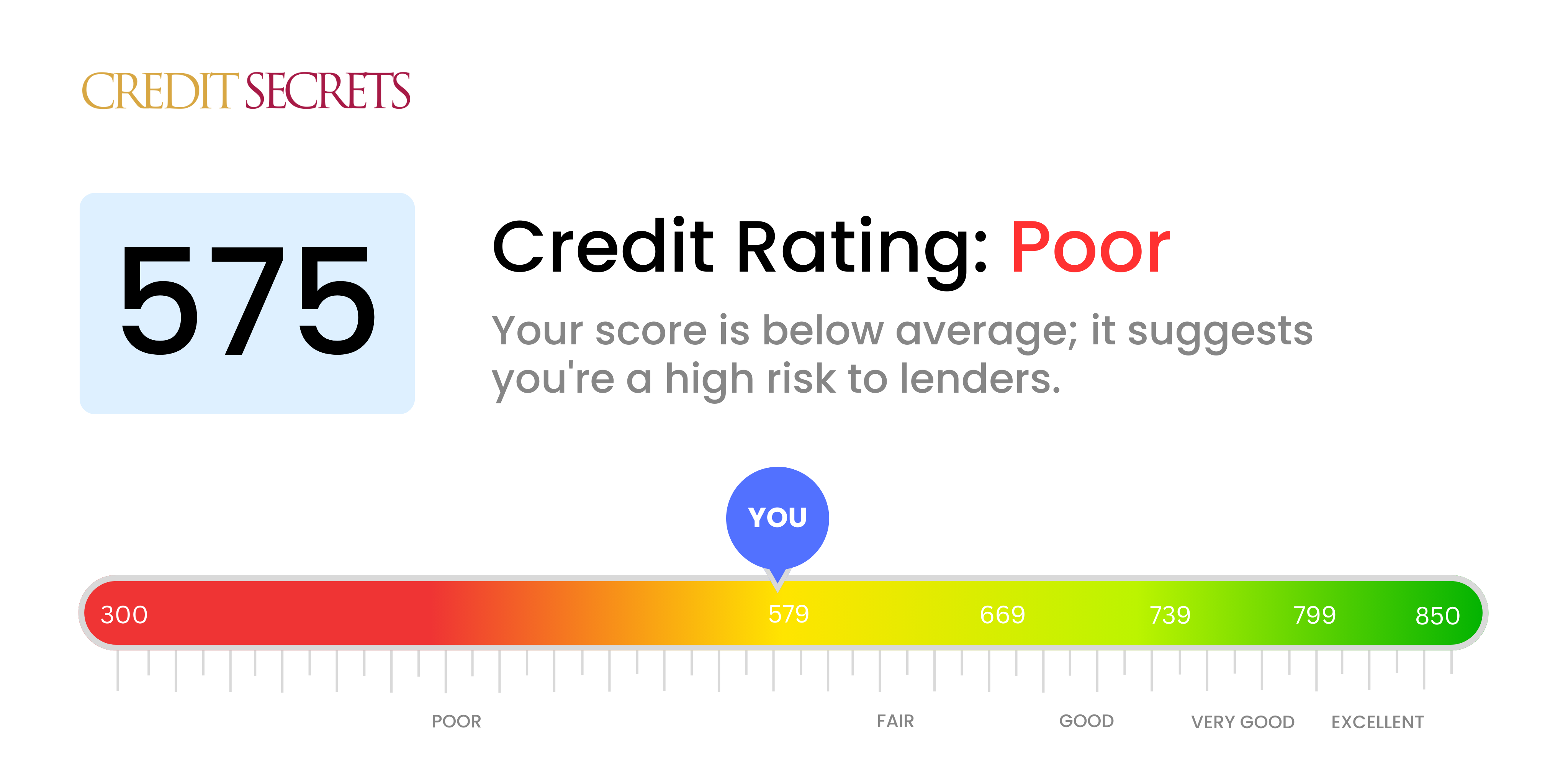

A minimum credit score of 575 or slightly higher is typically required by loan providers, so it’s unlikely that you will find a home loan with guaranteed approval. But these top lenders for mobile homes have low credit requirements. Cascade Financial Services offers Mobile Home loans for Manufactured homes. Contact us today to get started on your Mobile Home loan process! Best Bad Credit Mobile Home Loan Options. You probably aren’t going to find a home loan with guaranteed approval because most loan providers will require a minimum credit score of 575 or slightly higher. But here are some of the top mobile home lenders with low credit requirements. Vanderbilt Mortgage

Best Bad Credit Mobile Home Loan Options. You probably aren’t going to find a home loan with guaranteed approval because most loan providers will require a minimum credit score of 575 or slightly higher. But here are some of the top mobile home lenders with low credit requirements. Vanderbilt Mortgage The amount you can borrow with a personal loan for a mobile home depends on several factors, including your credit score, income, and lender policies. Many lenders offer personal loans ranging from $1,000 to $100,000, though the exact amount you qualify for will vary depending on credit score and other qualifications. Indeed, you can have several mortgage options to finance your mobile home with a 575 credit score. As long as you are buying or building a manufactured home after 1975, you can apply for any loans we have mentioned above. 21st Mortgage Corporation is a full service lender specializing in manufactured and mobile home loans. We originate and service a variety of loans to borrowers from manufactured home retailers, mortgage brokers and directly to consumers all over the USA. Apply for a manufactured home loan today. More Information... Borrowers with no credit score or a score below 575 need to put 35% down. This down payment can come in the form of land equity, trade-in, cash or any combination of the three. Although 21st...

Indeed, you can have several mortgage options to finance your mobile home with a 575 credit score. As long as you are buying or building a manufactured home after 1975, you can apply for any loans we have mentioned above. 21st Mortgage Corporation is a full service lender specializing in manufactured and mobile home loans. We originate and service a variety of loans to borrowers from manufactured home retailers, mortgage brokers and directly to consumers all over the USA. Apply for a manufactured home loan today. More Information... Borrowers with no credit score or a score below 575 need to put 35% down. This down payment can come in the form of land equity, trade-in, cash or any combination of the three. Although 21st... The best mobile home loans include USDA (best for rural areas) and Manufactured Nationwide (best for low credit scores). Financing a mobile home purchase can be tricky. Learn about the different loan types and which lenders can provide the best options for you.